Services

We Offer Services

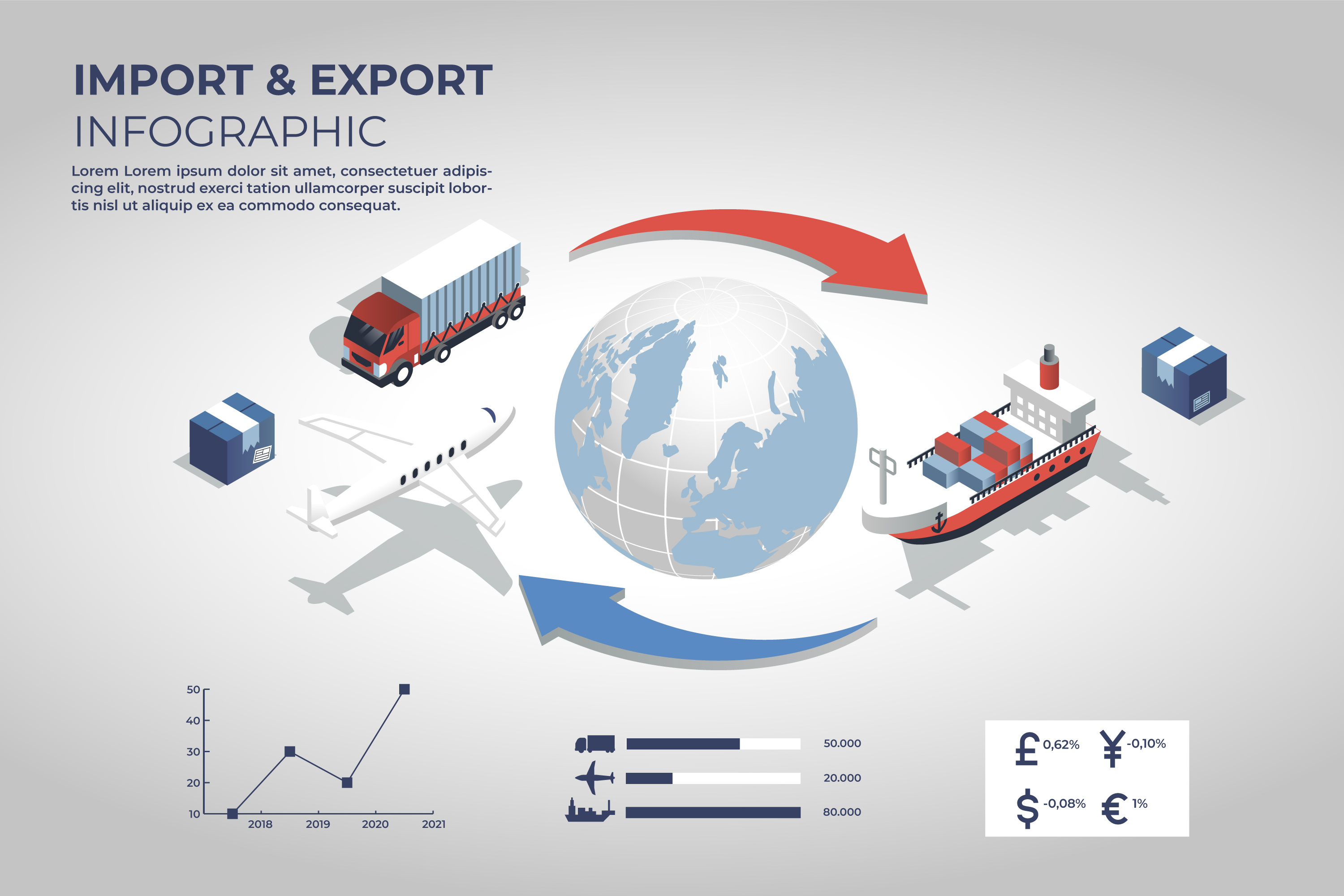

Foreign Trade Policy and Procedures

India’s Foreign Trade Policy (FTP) has, conventionally, been formulated for five years at a time and reviewed annually.

EPCG Export Promotion Capital Goods

EPCG Scheme is to facilitate import of capital goods for producing quality goods and services and enhance India’s manufacturing competitiveness.

Advance Authorization

Schemes under this Chapter enable duty free import of inputs for export production, including replenishment of inputs or duty remission

Status House Certificate

Status Holders are business leaders who have excelled in international trade and have successfully contributed to country’s foreign trade.

RODTEP

Scheme for Remission of Duties and Taxes on Exported Products (RODTEP) Notified by DGFT and administered by Customs.

TRQ Tariff Rate Quota

As per 2.107 of HBP, Government, from time to time, undertakes commitments for import under Tariff Rate Quota (TRQ) in various FTA/CECA.

Restricted

Any goods /service, the export or import of which is ‘Restricted’ may be exported or imported only in accordance with an Authorisation / Permission or Notification / Public Notice issued in this regard by the DGFT.

FSC – Free Sale Certificate

Free Sale and Commerce certificate for export of items not covered under Drugs & Cosmetics Act, 1940, which have usage in hospitals, nursing homes and clinics, for medical and surgical purposes and are not prohibited for export.